Learning Center

Investment for Retirement

Investment for Retirement

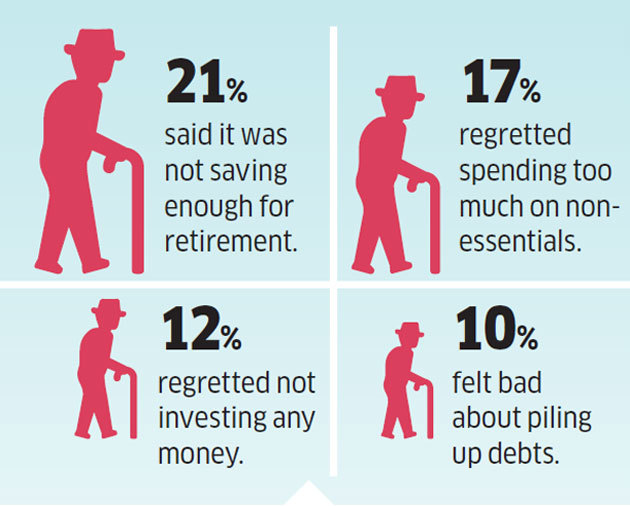

- 55% of senior citizens feel that they have not saved enough.

- 17% regretted spending too much on non-essentials.

- 12% regretted not investing any money.

- 10% felt bad about piling up debts.

As we get older, it is natural for many of us to feel proud of our accomplishments and to want to help those that we love financially, if possible. Whether it is children getting married, purchasing their first vehicle or their first home, or even financing your grandchild’s higher education, we are ever ready to help and support, at times even extend far beyond our capacity.

We seek transferring properties or any other assets in the names of our family members with the understanding that they will support us in our old age. We also give in to the loan trap with expensive education loans that can take care of college and higher studies. But have we given it a thought, that you can take loans out for college but never to pay for your retirement!

Simply put, by financially supporting your family members, you could be putting your own retirement at risk and you may not really be helping them prepare for the real world where there are no free rides.

Families have mostly become nuclear today, unlike the joint families where financial support was easily accessible. Medical expenses have been sky-rocketing as much as lifestyle diseases. We end up spending like the Western culture but without the support of their pension plan. We extend our capacities in order to help our families enjoy their lives without financially burdening them.